j-51 tax abatement phase out

The benefit varies depending on the buildings location and the type of improvements. J-51 Tax Abatement and Exemptions Webmeh 2021-07-08T1840190000.

Buying An Apartment With A J 51 Tax Abatement In Nyc Youtube

The penalty is 5 15 percent for each month the tax is not paid in full.

. Failure to File Penalty The failure-to-file penalty is calculated based on the time from the deadline of your tax return to the. J-51 Tax Abatement Phase Out. The exemption will last for a period of fourteen years with 100.

Residents must stay out of the building until cleanup and any required inspections have been completed. The j51 tax incentive program is designed for. The benefit varies depending on the buildings location and the type of improvements.

Available 247 providing effective IRS tax penalty abatement for Baltimore taxpayers struggling with tax debt penalties. 34-year 30-years full 4-years phase out or 14-year 10-years full 4-years phase out exemption from the increase in real estate taxes resulting from the work. Digging out of your tax penalty.

The credit is capped at 50000 in a 24-month period and must have a minimum. All residents including pets must be relocated if work will take longer then 24 hours. It depends on whether rent stabilization.

The 421g program is a real estate abatement program developed in the mid-1990s. According to the New York City Rent Guidelines Board landlords may or may not be able to raise the rent in buildings with J-51 benefits. The post-construction tax benefits phase out over time based on a set schedule and the property becomes fully taxable upon expiration of the abatement.

Subsequently receive J-51 or 421-a benefits. J-51 is a property tax exemption and abatement for renovating a residential apartment building. The exemption will last for a period of fourteen years with 100 exemption for ten years followed.

It incentivizes the conversion of commercial buildings for residential use. The rent is restored. If a building owner receives a J-51 tax abatement for an item that DHCR has issued an MCI rent increase order the rent is temporarily reduced in.

The credit is a one-time state income tax credit equal to 20 percent of qualified rehabilitation expenditures. The J51 tax incentive program is designed for renovations and conversions on existing residential buildings.

What Is The 421g Tax Abatement In Nyc Hauseit

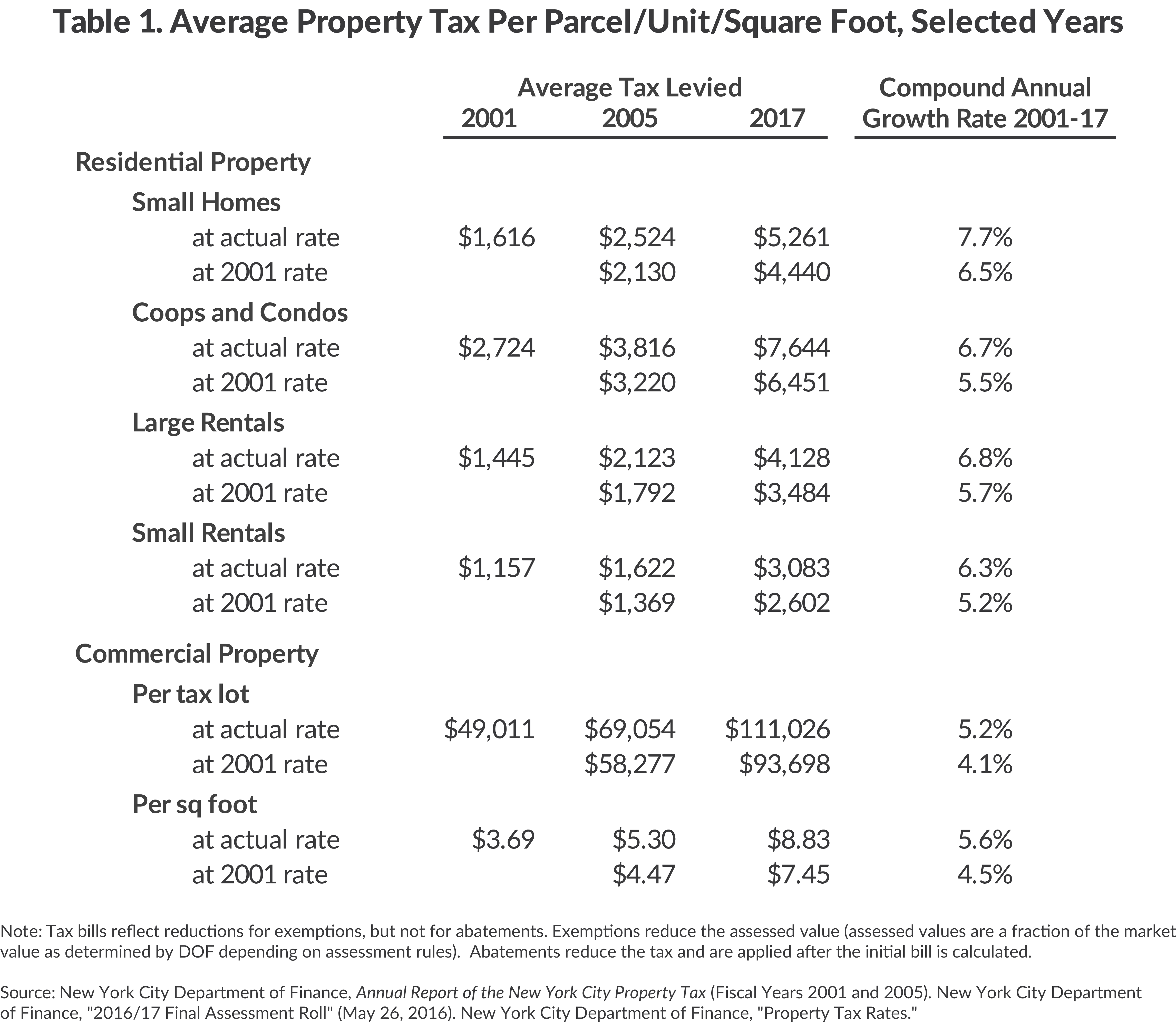

New York City Property Taxes Cbcny

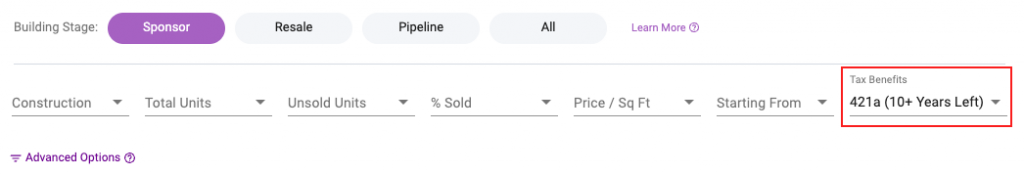

New Tax Abatement Filter Uncovers Property Tax Discounts In Nyc Blocks Lots

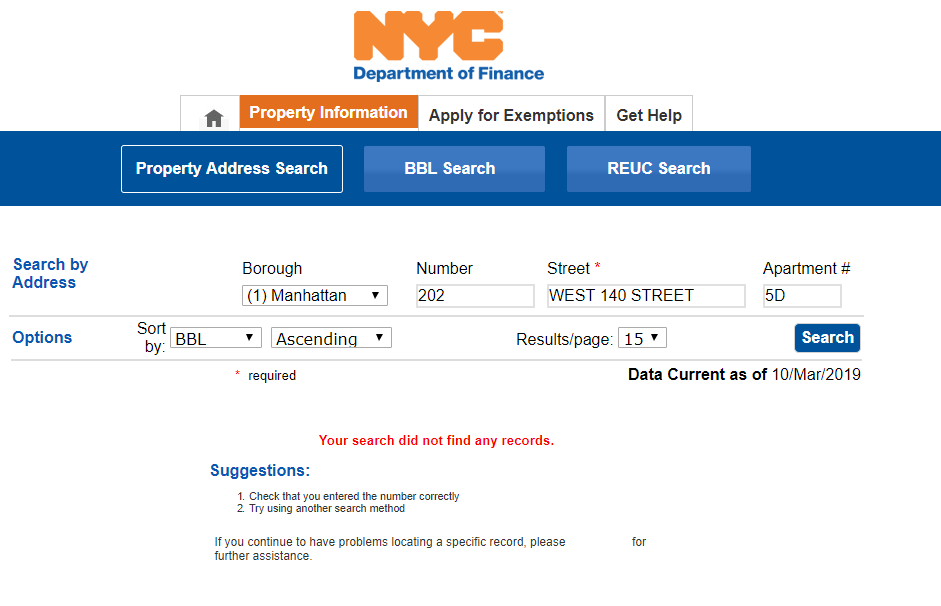

How To Find Out If Your Building Has A J 51 Tax Abatement And If Your Rent Was Raised Illegally

Buying An Apartment With A J 51 Tax Abatement Hauseit

New York Allows J 51 Tax Exemption For Buildings To Expire

A Look At J 51 And 421 A Abatements Taxing Questions Cooperatornews New York The Co Op Condo Monthly

City Council Weighs Extension Of J 51 Multifamily Tax Break

What Tax Benefits For Investment Properties In Nyc Nestapple

What Is The 421a Tax Abatement

J 51 Tax Program Decline Hpd To Revise

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Benefits Of A Historic District Morningside Heights Historic District Council

New York City Extends J 51 Tax Abatement Program

Equitable Effective And Feasible Approaches For A Prospective Fossil Fuel Transition Rempel 2022 Wires Climate Change Wiley Online Library

J 51 Tax Abatement In Nyc History Benefits Drawback And More